As nations continue their battle against a raging pandemic going into 2021, bubbling beneath the surface, is another crisis of a magnitude that might be hard to comprehend. An economy is simply derived from the actions of people and works in perpetual motion regardless of forces acting against it.

No crisis will lead to a full economic collapse as a full economic collapse is purely an imaginary outcome of a creative mind. A crisis typically introduces an inflection point, changing what is considered normal flow of activities, bringing about changes, either by creation or destruction.

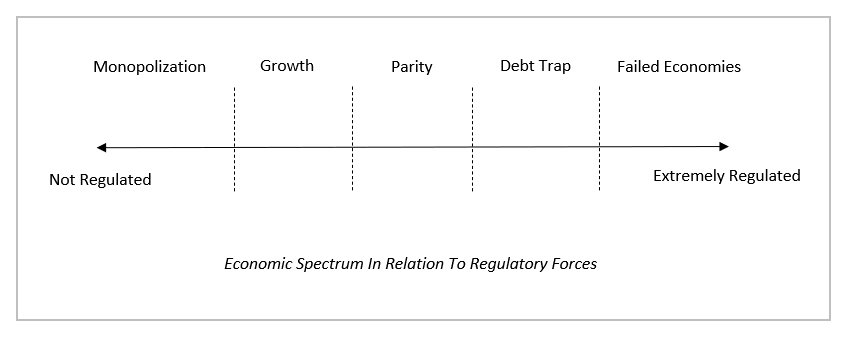

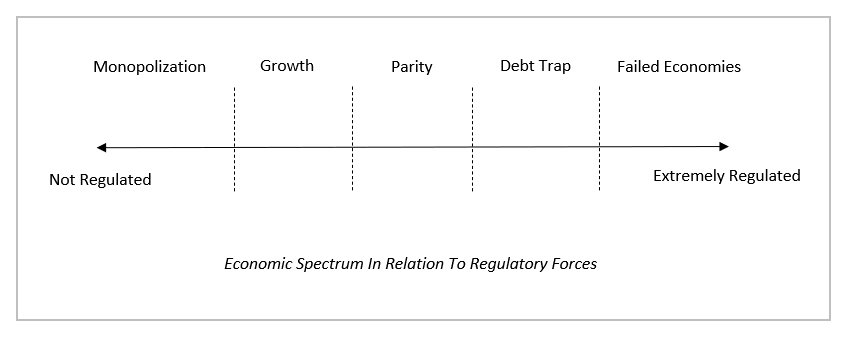

In a modernize society, city states are formed in order to provide what is a called a governmental structure that regulates these activities, in economic terms - economic activities. This can be expressed in a simple manner using the representation below:

All types of control on economic activities fall under the regulatory umbrella. Monetary policies like benchmark rates, base rates, exchange rates, lending rates, adjustments, reserves are used in unison or individually to control the regulated currency, and its supply in the market.

Fiscal policies are typically associated with taxation, spending and expenses. However, this is an inaccurate way to look at fiscal policies vs currency, as taxation serves as a sink to currency inflation and is not a fiscal policy which is used to dictate spending and expenses.

Contrary to popular beliefs, governments are no different than households, even if the government has the ability to produce and dictate currency. This is why when a government increase its spending or reduces its expenses, it should do so without taking taxation into account.

If a government creates a currency by either borrowing or spending more, it must counteract the effects by increasing taxes and vice versa. Another fiscal policy that mainstream do not take into consideration are laws governing economic activities like corporation, licensing, or laws around how trade is conducted. This is the second paradigm that should be considered in a fiscal policy but is often overlooked.

The evidence of both of these can be found in current economic datasets; for example online MMORPG’s provide economic models of how currency inflations happen and how currency sinks like fees and tax can be used to reduce the currency in circulation, laws around trade affects how people and businesses conduct their activities and this can be seen in US monetary velocity from Q2-2017 to Q4-2018 where the action of the US administration to actively reduce the number of laws governing trade activities lead to better inflation and growth.

The Bretton-Wood Agreement set the framework for a dollar denominated international trade system which established the framework for our modern financial system. Without it, we would not be enjoying the fruits of labor of a globally integrated supply chain.

The dollar system was initially backed by a tangible commodity through a mechanism known as the gold standard, which President Nixon decoupled the dollar from in 1971 and created the Fiat system, a system only backed by confidence in the dollar. Over time, the key institutions created during the Bretton-Wood error like the World Bank and IMF, has kept the confidence of the dollar as a secure source of value swap throughout the developing world.

The dollar through various interchanges like EuroDollar, Swift, LiBOR has provided easy access to the dollar. The US is called a Capital Market and its domestic companies stocks and bonds are highly coveted because of the dollar liquidity it provides the rest of the world and allows them to trade with other countries easily.

The power of a currency is dictated simply by its ability to remain liquid enough whereby it holds an intrinsic value, but has sufficient demand so it can be exchanged easily. Remote regions of the world might recognize the greenback and accept it as payment compared to other major currencies Euro, Yuan, Swiss Francs, Yen.

The best measure of a currency intrinsic value is to see the prevailing currency’s action and sentiment in an unregulated market. In an unregulated market, a currency obtains its value purely on the basis of intrinsic value and faith that someone else will be willing to accept this currency in exchange for something else of value.

The ease of this exchange dictates the usage of this currency and this theory can be found proven with the introduction of cryptocurrencies like Bitcoin, Ethereum and the like. These currencies were quickly pegged to the dollar to provide it an interchangeable value that can be used as a benchmark of sort.

In Bitcoin, given there is no official regulatory structure, its value is highly volatile and the rest of the cryptocurrencies are benchmarked to it given it is currently the most in demand currency. This is also another reason why monopolization of Bitcoin is happening at this stage as the economic spectrum defines it as such.

Ethereum on the other hand is regulated lightly through the Ethereum Foundation and its currently in its growth stage with the introduction of ETH2.0. Bitcoin will soon be regulated as more mainstream participants exchange their currencies for Bitcoins creating risks for more regulated currencies.

In order for a currency to be widely accepted and used, it must be made available to a worldwide audience either through marketing or actual usage. After WW2, the United States was the biggest commodity purchaser and purchased commodities in US Dollars, creating the dollar liquidity into the world market. In the turn of the 21st century, it did so by importing end user products from various sectors and making the payment in US dollars. SWIFT, credit card (Visa, MasterCard) and petrodollar systems all provide dollar liquidity to markets around the world.

The US dollar became the preferred currency of choice replacing the British Pounds in 1914 during WW1 and the federal reserve act establish the US federal banking system on Dec 23,1913. At the end of WW1 the US dollar once again returned to the gold standard and remained on the gold standard until 1971.

To improve the system of transferring cash to between bank accounts physically, the federal reserve created a system known as the “Repurchase Agreement” or “Repos”. These “repurchase agreements” are going to be the main cause of the Dollar Financial Crisis.

A repo or repurchase agreement is a simple loan agreement where the loan is collateralized by a secure asset, typically US treasury bonds or government issued securities. These repurchase agreement might or might not actually transfer the security that is being put up for collateral.

If the borrower does not hand over the security being used as collateral, it can or might reuse the same collateral against a different repo operation. A lender too can also use the same collateral to borrow against creating a leveraged situation.

This is the reason a repurchase agreement is known as a derivative and can create an infinite amount of leverage until it reaches a form of inflection point where enough creditors refuse to accept collateral. A good read on how fragile and leveraged this system is explained eloquently by Caitlin Long in a Forbes article title “The Real Story Of The Repo Market Meltdown, And What It Means For Bitcoin”.

In March 2020, when the repo market caused a fire sale and liquidations by market borrowers in order to meet their repo obligations, the federal reserve stepped in to provide liquidity to the market through various programs like swap lines, term asset-backed securities loan facility, and direct cash injection (nearly 1 trillion every day from March 24 to March 31) into the repo markets which stabilized the markets restoring the ability of borrowers to pay of lenders without selling assets at a huge discount.

Why is the repo market is so important? All participants in the repo markets are major institutions; banks, hedge funds, government backed banks, central banks, private equity etc. To give perspective to the scale of the repo market, it is estimated the repo market transacts close to 2 trillion to 4 trillion every day.

It could be a mere coincidence that the boom period in repurchase agreements correlates to the “Roaring Twenties” and the Great Depression brought an end to highly leveraged repurchase agreements. Repurchase agreements then picked up further with the removal of the US dollar from the gold standard and the introduction of computers in the financial markets in the 1970’s and 1980’s.

The collapse of Lehman Brothers and Bear Sterns was not caused by mortgage derivatives as commonly stated, but the mortgage derivatives collapse because Lehman Brother and Bear Sterns were unable to get financing in the repo markets.

To understand how the dollar works we need to understand how the dollar is issued. The dollar can only be issued by two institution in the United State, the Congress and Commercial Banks which are part of the Federal Reserve System.

It is introduced by commercial banks via lending and by congress via various types of bonds (tbills, notes, bonds), all other money introduced to the system happen due to inflation caused by the interest attached to the issuance of the loan or bonds.

Via Quantitative Easing, the Fed or Federal Reserve buys US treasury securities in return for cash and keeps it on its “balance sheet”. The Fed is called an independent institution simply because it funds itself and given its holding of securities and the interest are of a higher magnitude than its expense, its quantitative easing program is deflationary, simply because interest money that were supposed to be spent into the market it now sitting in its bank and the Federal Reserve has no way to spend it into the monetary system.

To give scale to this notion, the Federal Reserve now holds USD10 Trillion in securities generating interest, that loss of interest in the market is the rate of deflation of the dollar.

The following is the breakdown of recorded holdings of US treasuries:

It is estimated that the EuroDollar system, fixed and time deposit held outside the US, was estimated to be USD 13 Trillion sometime around 2016. The Eurodollar market, despite its name, is not regulated or backed by the US or the Fed. The Eurodollar market is one of the major creator of demand for US Securities via repurchase agreements. In simple math, the outstanding US Debt(issued via treasuries) is 27 Trillion and USD 23 Trillion are held by known market participants, USD 10 Trillion of that has a deflationary interest, up to 2016 we know that there is a shortfall of USD 9 Trillion USD in the market (and additional amount from 2017-2020 including interest). Where is this amount going to come from one might ask?